Proving Value in the Age of AI

What CMOs Need to Know

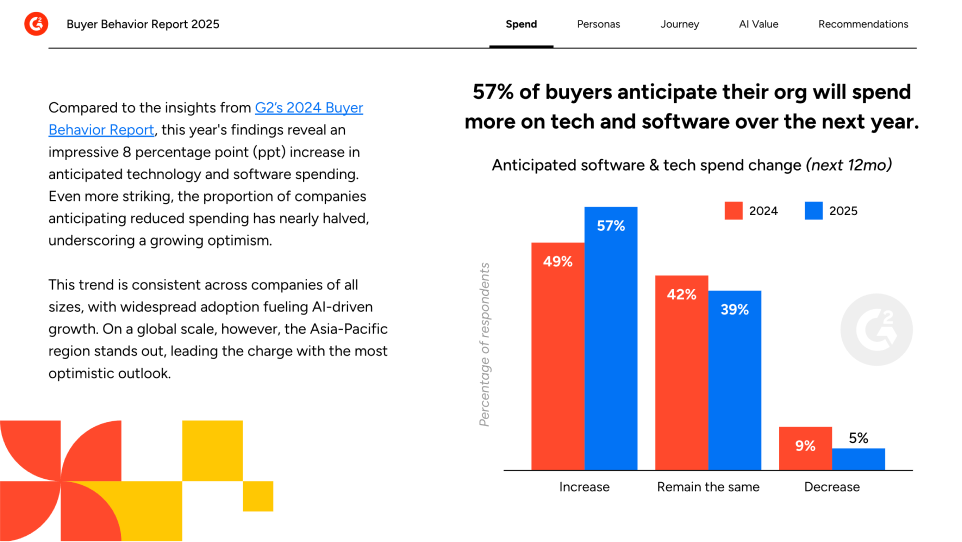

I wanted to share some highlights and insights from the 2025 G2 Buyer Behavior Report, our global survey of B2B software buyers. This year's report highlights how drastically buyer behavior and preferences have transformed in just the last eight months, thanks to AI. And here’s the headline: Our research shows that AI chatbots are now the #1 source influencing vendor shortlists.

We interviewed 1,100 B2B decision-makers globally, and the results confirm what many of us have been feeling: AI is no longer optional or experimental. It now stands for "Always Included." For CMOs, that means a fundamental shift to our go-to-market playbooks as our buyers’ behavior has changed.

AI is reshaping everything from how buyers research to who's at the decision-making table and even what they're willing to pay for. I've compiled the most critical takeaways — the insights that directly impact how we drive demand, build trust, and prove ROI in this new AI-driven era.

Sydney Sloan

Chief Marketing Officer at G2