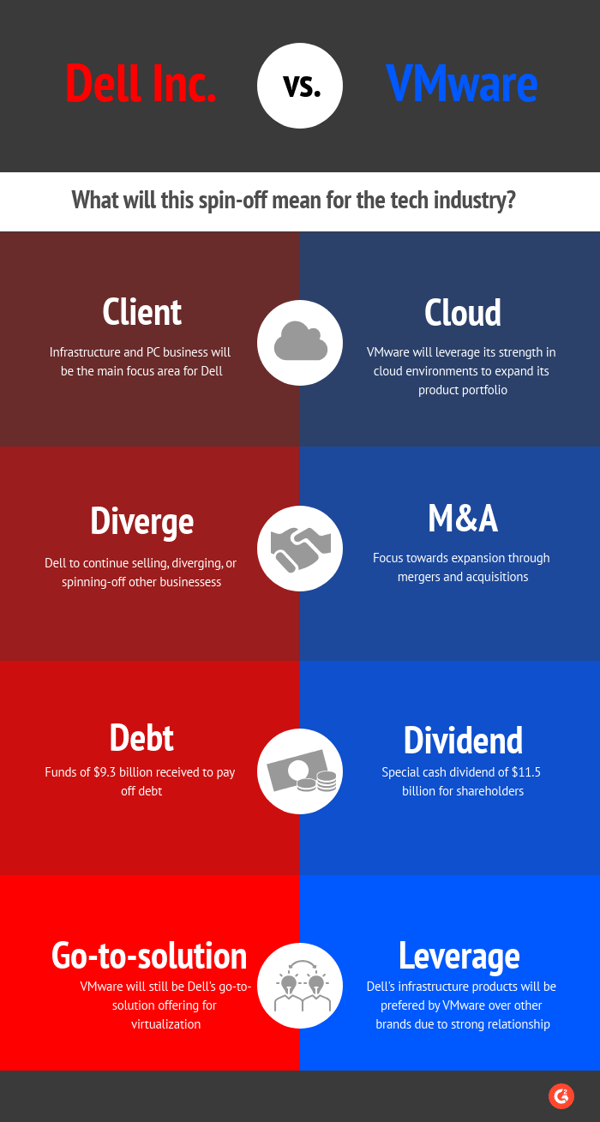

Tech giant Dell announced that it has completed the spin-off of VMware, which will result in the creation of two stand-alone companies. The spin-off was completed by a special dividend of 30,678,605 shares of VMware Class A common stock and 307,221,836 shares of VMware class B common stock. Dell’s expectations from this spin-off are pretty clear—VMware is set to be worth much more as an independent entity, rather than being under the Dell family.

An important point to note is that Dell and VMware both expect to leverage and continue their closely built partnerships. Product life and availability of enterprise products such as VxRail are not expected to be hampered by the spinoff.

The VMware spin-off and its implications

Back in April 2021, Dell had made the first announcement of their plans to spin-off VMware. The announcement comes amidst a very strong market share that VMware has gained over the years of being the go-to virtualization platform. The growth of VMware especially after the pandemic has been nothing short of explosive. VMware’s revenue from Subscription as SaaS segment saw the highest growth at 29% to $741M.

With this spin-off, VMware has more freedom and leverage to expand its business. This includes acquiring more companies and focusing on more funding options. VMware would have their company funds to focus on individual acquisitions. At G2, we are expecting to see a bigger influx of cloud/cloud-driven companies to come under VMware’s acquisition spree.

In an interview with CRN, Raghuram Ranjan, CEO of VMware said:

“We will continue to acquire companies that fit into this portfolio. So that’s where I expect the bulk of our (M&A) activity to come from. I expect continued activity with respect to small, tiny tuck-ins of companies as we see fit.”

What does this mean for Dell?

For Dell, the biggest takeaway from this spin-off is more focus and planning around its capital structures, along with a re-energized focus on infrastructure markets. The huge debt that it incurred while acquiring EMC at $67 billion in 2016, in one of the biggest tech acquisitions the industry had ever seen, while likely manageable by the likes of Dell, could still be potentially risky and can be a cause of concern for potential investors. Dell’s large debt has created poor credit ratings for the company which has affected VMware’s as well, but with the spin-off, this is expected to change.

Dell will also focus on keeping its partnerships in sales, with partners, distributors and several other parties close and ensure to provide continual support to all parties. The partnerships are key for Dell to help customers on their digital transformation journey.

Michael Dell, chairman and CEO, Dell Technologies said:

“Today marks an important milestone for both Dell and VMware. We are unlocking significant value for stakeholders while maintaining our close partnership in sales, support, and innovation for our customers. We are full speed ahead, solving customer problems, driving progress, and capturing opportunities in areas like multi-cloud, edge, and telecom."

What does G2 expect to happen?

As the integration of multi-cloud in each industry, be it healthcare, HR, education, or even construction starts to grow, VMware stands to benefit the most from the spin-off. The growing focus on cloud and cloud technologies has created the need to support customers on their digital transformation journeys, and now VMware can focus on working and expanding in this space.

Since the pandemic, Dell’s client solution group has seen tremendous growth. The WFH and remote learning created a surge in requests for laptops and PCs. Dell’s fourth quarter results for 2021 were a record-high $13.8 billion, up 17% YoY, with 50.3 million units sold in 2020.

What is interesting to note is that the expectation initially was that once the pandemic ceases the shipments would drop, however, we are seeing a bigger growth. In Q2 FY22, Client Solutions Group revenue was $14.3 billion, over a 27% record increase. The major reasons for this include huge shipments from medical companies and from governments that require all these infrastructures to manage the tons of information collected during the pandemic.

Considering this continuous growth, it makes sense for Dell to spin-off VMware to refocus on its client infrastructure side, and invest all its time and energy to ensuring that they achieve number one status across several different infrastructures such as PCs, laptops, monitors, servers, HCI, etc., while all the same maintaining a strong relationship with VMware.

G2 expects that VMware, on the other hand, will focus on not just strengthening its Dell portfolio (Vxrail) but also several other key vendors in the space such as HPE, Lenovo, Supermicro, etc.

Dell’s spin-off from VMware was a long time coming. Now that it’s here, it's exciting to see how these giants in their respective spaces maintain their relationship, while at the same time expanding into newer areas.

by Preethica Furtado

by Preethica Furtado

by Preethica Furtado

by Preethica Furtado

by Preethica Furtado

by Preethica Furtado