This post is part of G2's 2024 technology trends series. Read more about G2’s perspective on digital transformation trends in an introduction from Chris Voce, VP, market research, and additional coverage on trends identified by G2’s analysts.

Competing in the cloud: usability and simplicity will be key drivers

Prediction

By 2025, more than 50% of cloud solutions will have automation capabilities to enhance simplicity and usability, as vendors prioritizing these attributes in addressing enterprise challenges will outpace their competitors.

As observed with the 51% rise in traffic to G2's Cloud Migration category last year, cloud investments are rising. The cloud computing market, valued at $545.8 billion in 2022, is expected to more than double by 2027, according to a report by Markets and Markets.

But despite the growth, vendors still battle competitors to capture a greater market share.

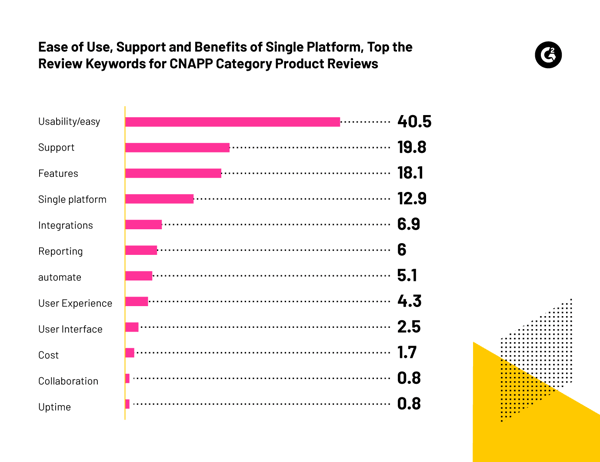

In the coming year, we’ll see the vendors best their competitors by addressing key enterprise drivers—simplicity and usability. This is supported by reviews for the Cloud-Native Application Protection Platform (CNAPP) category on G2, which reveal “Usability” and “Ease of Use” that a single platform provides are the most liked capabilities of the software platform.

In the coming year, we’ll see the vendors best their competitors by addressing key enterprise drivers—simplicity and usability. This is supported by reviews for the Cloud-Native Application Protection Platform (CNAPP) category on G2, which reveal “Usability” and “Ease of Use” that a single platform provides are the most liked capabilities of the software platform.

Winning vendors will deliver by streamlining customer cloud environments

On average, a company uses around 254 SaaS applications, according to EnterpriseAppsToday. Managing them can be daunting. So, companies are now opting for solutions from a single vendor that are easy to integrate.

The goal for companies next year would be to create a more efficient and cohesive infrastructure through consolidation that allows for easier management and optimization of cloud resources.

AI and automation are critical for enhanced efficiency and simplicity

Automation is the key to reducing complexity in cloud operations. For example, auto-scaling software that provides automated resource scaling powered by AI allows dynamic management of resources based on capacity demands.

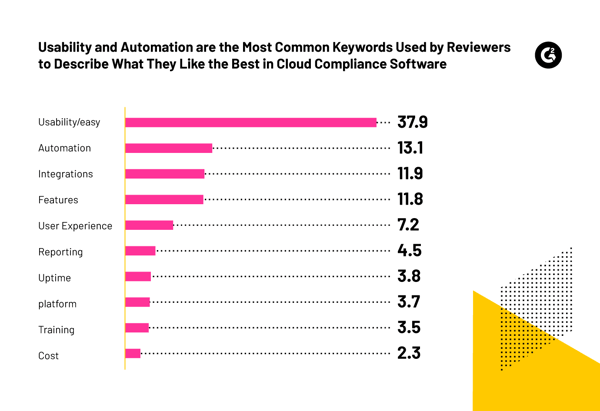

14% of G2’s Cloud Management Platforms category reviewers talk about automation. We expect this number to grow in the year to come as the focus on automation increases. Cloud Compliance Software is another example where users look for automation to ensure compliance and remediation across the diverse cloud environment with minimum manual intervention.

In addition, AI-driven cloud cost management tools and cloud management tools can provide granular insights into cloud expenditure, categorizing spending by department, project, or individual. They can also suggest cost-saving measures, such as resizing underutilized resources, recommendations on resource usage, and efficient cloud services.

Cloud consolidation and automation: a recipe for success

As the cloud takes center stage in business operations, these strategies will not only streamline operations but also unlock the latent potential of cloud investments.

With a concerted effort towards consolidation and automation, enterprises can achieve significant cost savings and enhance performance, ultimately leading to successful business outcomes through cloud investments.

However, companies must thoroughly assess their processes and current software infrastructure to prevent consolidation and automation efforts from merely adding to the cloud expenses and identify areas ready for optimization.

Find out how hybrid cloud has emerged as the halfway point to get the best of both on-premises and cloud options.

Edited by Shanti S Nair

by Rachana Hasyagar

by Rachana Hasyagar

by Rachana Hasyagar

by Rachana Hasyagar

by Rachana Hasyagar

by Rachana Hasyagar