This post is part of G2's 2024 technology trends series. Read more about G2’s perspective on digital transformation trends in an introduction from Chris Voce, VP, market research, and additional coverage on trends identified by G2’s analysts.

Healthcare is ready for AI solutions that can go the extra mile

Prediction

In 2024, healthcare organizations that make smart investments in AI-powered solutions will see improved ROI.

The key word is smart. These AI investments should be focused primarily on medical practice management, medical billing, and patient engagement solutions.

AI adoption is not a question of "if" but "how"

There’s still much to determine around the practical and ethical applications of this technology, but healthcare organizations understand that AI is not merely a quick fad.

Based on the G2 Software Buyer Behavior 2023 report, 78% of healthcare industry respondents said that it is important or very important that the software they purchase moving forward has AI functionality.

When asked to rank their most important considerations for buying software, respondents ranked receiving a return on investment within one year as the most important.

Adopting AI for its own sake is a recipe for disaster, especially in an industry dealing with high levels of employee burnout and limited resources to experiment with new technology. Healthcare organizations need to identify an area within their workflow that could benefit from AI-powered software and build an action plan from there.

A 2023 survey published by Holon Solutions found that healthcare workers spend 34% of their time on administrative work, and 72% stated that they would be very or extremely interested in technology that cuts down the time of administrative work.

Healthcare leaders can tackle two problems at once—investing in AI-powered solutions will not only result in quicker time to ROI but also bring the added benefit of reducing the administrative burden on healthcare workers.

Prime areas for this investment include practice management, medical billing, and patient engagement, as they encompass key business functions for clinical and administrative staff.

For G2 healthcare reviewers, reported time to ROI falls short of the ideal timeframe

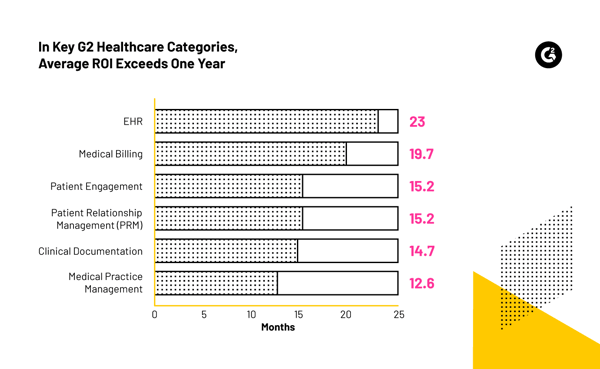

Across six key healthcare categories on G2, reviews gathered between August 2022 and August 2023 show an average time to ROI that exceeds the ideal one-year benchmark determined by our Buyer Behavior healthcare respondents.

These categories were chosen for their potential to utilize AI-powered features and for the recent proliferation of new G2 products with these advanced features.

I concede that ROI for EHR software may never reach that golden target. Given the sheer wealth of data these solutions house and their role within the healthcare tech ecosystem, it makes sense that buyers take this purchasing decision quite seriously. You can’t rush an EHR implementation.

Within the medical billing and clinical documentation realm, however, AI can help reduce human errors, optimize workflows for claims management, and enable clinicians to maintain up-to-date patient records and aftercare summaries that the patient easily understands.

Within patient engagement and relationship management, AI helps engage with patients at the right time through the right channel. For routine care, this might involve sending reminders to schedule yearly exams or vaccinations, as well as sending relevant educational resources and feedback requests after a patient visit.

The bottom line?

The healthcare solutions of yore simply do not cut it anymore. In 2024, healthcare staff need modern software that embraces AI to deliver reduced administrative burdens for themselves and improved experiences and outcomes for their patients.

Smart investments into AI-powered solutions will drive ROI in healthcare

In an industry whose work literally saves lives, measuring software ROI can get murky. As healthcare organizations embrace AI-powered solutions, they should ensure they understand how the product can help them and their patients and if they're ready to implement such a product.

AI, for its own sake, will likely lead to disaster for organizations. Smart investments, though, will help identify products that can replace existing solutions, reduce the time that staff spend on administrative tasks, and ultimately drive faster ROI.

Learn how AI is transforming patient engagement.

Edited by Jigmee Bhutia

by Dominick Duda

by Dominick Duda

by Dominick Duda

by Dominick Duda

by Dominick Duda

by Dominick Duda