Financial planning and analysis (FP&A) platform DataRails recently announced it had raised $50 million in a Series B funding round, led by Qumra Capital. This investment follows the announcement on June 21, 2021, about its last round of funding, which raised $25 million in a Series A extension.

Based out of New York and Israel, the startup works on building better financial automation tools for small and mid-size businesses (SMBs). According to a GoSkills article, human resource consulting firm Robert Half claims that 63% of American companies still prefer Microsoft Excel as their most sought-after accounting tool. DataRails sees this as an opportunity to innovate the traditional way of handling finance and accounting for most businesses.

DataRails focuses on providing diverse FP&A solutions

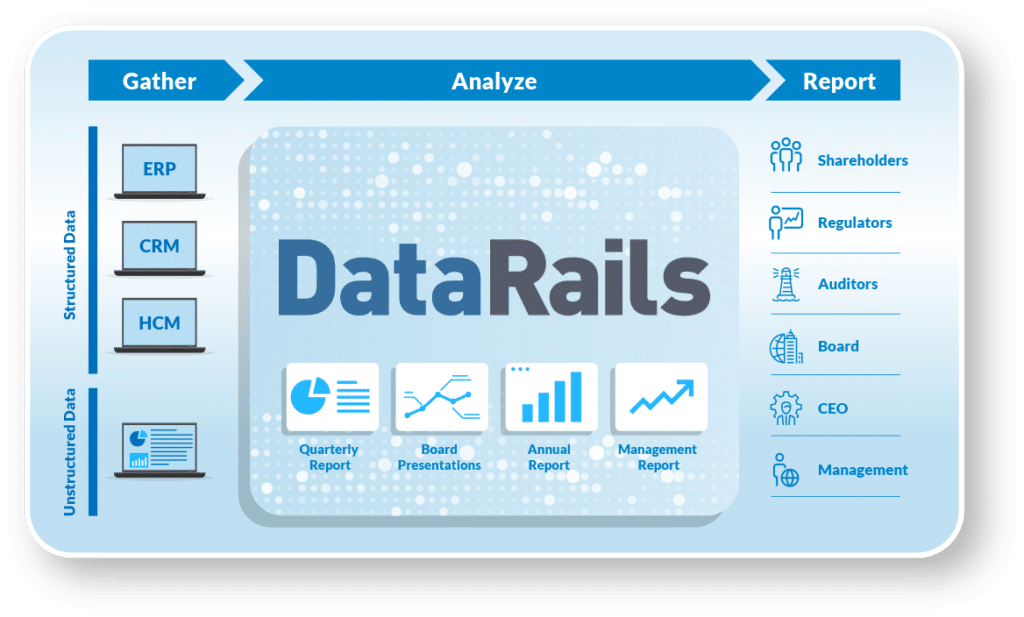

Finance professionals are increasingly facing issues in gathering, analyzing, and reporting large amounts of financial data. A considerable amount of time is invested in figuring out data scattered across many different spreadsheets and applications. DataRails, a budgeting and forecasting software on G2, provides a solution.

The company helps finance departments eliminate time-consuming manual processes, streamlining their financial reporting and planning to focus on what matters. It offers core finance solutions like financial reporting, financial analytics, financial close, and provides support for corporate performance management.

Source: Sage Intacct

Founded in 2015, DataRails' initial priority was to provide a platform to elevate Excel, which is widely used across organizations to manage profit and loss statements, balance sheets, budgets, reporting, and auditing for taxes and compliance purposes. In recent years, the company has refocused its priority towards creating more value for customers by digging deeper into analytics and integrating with other financial and accounting software like Sage Intacct, QuickBooks, Xero, SAP ERP, Salesforce, etc., through financial data APIs.

With the help of the latest investment, the company aims to go beyond traditional excel automation and tap into Google Sheets, Numbers by Apple, etc., and deliver value-added services by integrating with more partners, per TechCrunch.

G2 envisions growth in the Budgeting and Forecasting Software category

Budgeting and forecasting are key financial functions for every business. It helps companies formulate growth strategies by estimating the revenue and income that need to be achieved by a particular period in the future.

Investment into platforms such as DataRails proves that companies are increasingly looking towards enhancing features in their financial analytics platforms to include budgeting and forecasting, cash flow management, corporate performance management, etc. G2 lists several software offerings in its Budgeting and Forecasting category to help buyers find the right software for their company.

In the past 12 months, the Budgeting and Forecasting category has grown by 12.5% in terms of new product addition, with 153 total products currently. Similarly, overall category reviews have increased by 93.5% in the same period. Vendors in this category have grown, urged by the increasing interest from businesses looking for solutions to automate their finance-related activities. It is interesting to note that existing software users are actively sharing their experience with buyers to help select the right financial software for their organization.

With the increasing need for well-equipped tools that meet all of a company's financial demands, G2 expects to see a continued rise in budgeting and forecasting software demand.

Edited by Shanti S Nair

by Subhransu Sahu

by Subhransu Sahu

by Subhransu Sahu

by Subhransu Sahu

by Subhransu Sahu

by Subhransu Sahu