Mambu, a core banking software, has recently raised €235 million funding in its Series E round, reaching a valuation of €4.9 billion (around $266 million at a $5.5 billion valuation) led by EQT growth, a European private equity firm. This investment has come after the SaaS banking platform raised €110 million (around $135 million) in its last funding round earlier in January.

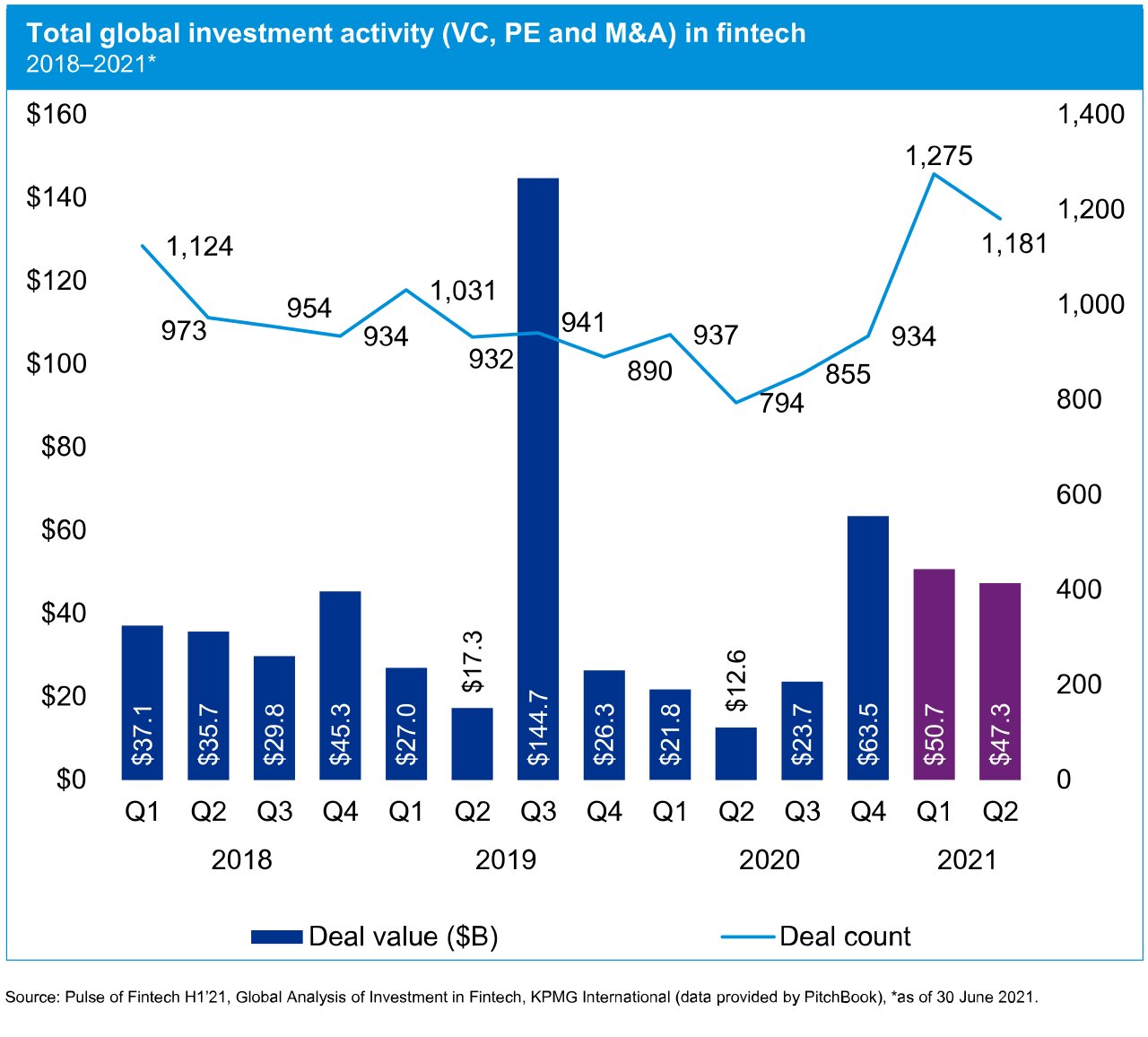

As the financial service industry grows by leaps and bounds, 2021 marked a record-breaking year of financial investments with efforts to nurture fintech, financial products, and make consumers digital ready. The global fintech market recorded an investment of $98 billion in H1, 2021 with a volume of 2,456 fintech deals, according to the consulting arm of KPMG.

Source: KPMG

Mambu enabling banking as a service (BaaS)

There is an increasing need for modern banking software as customers demand frictionless digital banking experiences such as digital payments and lending, insurance, wealth management, etc. Fintech companies operating as BaaS have seen the opportunity to develop and offer APIs to integrate banking and other financial technologies. This helps to optimize their end-to-end process ensuring complete management and deployment of modern APIs.

Founded in 2011, Mambu started out by servicing microfinance institutions and fintech startups but has since expanded to develop APIs to support lending, deposits, and various backend technologies that power banks, lenders, fintech, and financial institutions. Mambu has also ventured into providing modern banking support to telcos and e-commerce companies that may not be equipped with the necessary financial capabilities.

Eugene Danilkis, Mambu’s CEO says,

With a year-on-year growth of more than 120% in Q3 of 2021 and deploying capabilities for N26 neo bank, Raiffeisen Bank, BancoEstado, and ABN Amro, Mambu’s efforts lie in reforming the banking industry as well as in the migration of traditional banking institutions onto more modern tech stacks.

G2 envisions global banking revolution

Revolution in the banking industry has led to the birth of various fintech companies providing cloud-based banking solutions and integrated tools for smooth financial operations. G2 data provides a deep insight into the rise of traffic in Financial Services categories centered around core banking software, digital banking platforms, and mobile banking software.

Data insights from G2 illustrate the traffic increase in its Financial Services categories from H1 of 2020 to H1 of 2021. The Core Banking Software category has seen a spike of 95.21%, whereas Digital Banking and Mobile Banking have experienced an increase of 89.52% and 133.51% respectively. This traffic surge in H1 of 2021 is attributed to an increase in the volume of investment deals into players in the financial services sector including fintechs, microfinance, and SMBs looking for financial software products in these categories.

With increasing competition in the financial sector led by the growth of fintechs, a massive banking revolution, and changes in consumer behavior, G2 helps businesses by acknowledging their search for the right financial software capabilities.

Subhransu Sahu

Subhransu is a Senior Research Analyst at G2 concentrating on applications technology. Prior to joining G2, Subhransu has spent 2 years working in various domains of marketing like sales and market research. Having worked as a market research analyst at a renowned data analytics and consulting company based in the UK, he holds expertise in deriving market insights from consumer data, preparing insight reports, and client servicing in the consumer and technology domain. He has a deep inclination towards tech innovation and spends most of his time browsing through tech blogs and articles, wiki pages, and popular tech channels on youtube.

by Subhransu Sahu

by Subhransu Sahu

by Subhransu Sahu

by Subhransu Sahu

by Subhransu Sahu

by Subhransu Sahu