Upgrade, the loan origination software, has recently announced $280 million funding in its Series F round reaching a $6 billion pre-money valuation. This sharp increase in the valuation has come up after its Series E round of $105 million, earlier this year.

The Series F funding round announced on November 16, 2021, was led by DST Global and Coatue Management with participation from Dragoneer Investment Group and some of existing investors including G-Squared, Old Well Partners, Koch Disruptive Technologies, Ribbit Capital, Sands Capital, Ventura Capital, Gopher Asset Management, and Vy Capital.

Upgrade’s journey as a fintech unicorn

As businesses continue to navigate through the impacts of the COVID-19 pandemic, the fintech space has witnessed unprecedented funding opportunities amidst the crisis. According to the State of Venture Q3 '21 Report, global fintech marked a record $91.5 billion funding this year, doubling the funding collected in the entire of 2020. Also, the past quarter saw the entry of 42 fintech startups into the billion-dollar club (fintech unicorns) making it to a total count of 200 for this year.

Upgrade, the San-Francisco-based neobank began its journey in 2017 with a mission to offer customers more value and a better experience than they receive from traditional banks. Now, it is recognized as America’s fastest-growing fintech company in 2021 growing at a cagr of 686.2%, as per ranking provided by the Financial Times.

Upgrade’s credit processing solutions consist of:

- Affordable personal loans with a low fixed rate of interest and easy monthly installment repayment options to ease the burden on the debtor

- The Upgrade Card which comes with no fees and set payoffs, breaks down balances from each month at a fixed rate, and sends rewards on each monthly balance payment

- Rewards checking offers 2% cashback on common everyday expenses like grocery, restaurants, gas station, utility bills, subscription bills, and 1% cashback on all other charges.

- Credit health helps track and recommend tips tailored to credit history to maintain a healthy credit score for free.

Philippe Laffont, founder and CEO of Coatue Management, and a major investor of Upgrade said:

“Credit is a key component of banking and has been a major source of revenue for banks. We are excited by Upgrade’s innovative credit products that we believe can help the company capture a significant share of the mobile banking market.“

How is Upgrade disrupting the traditional banking industry?

According to the U.S. Mastercard/Visa Credit Card Issuers–Midyear 2021 report from Nilson, Upgrade credit cards are the fastest-growing credit cards in the US. Upgrade won over some of the most household bank names to come at the 48th spot in the top 100 credit card issuers list.

The idea behind the success of Upgrade is the promise that it gives to its customers—financial discipline. Rising credit card debts and debt schemes have plagued many people all over the world, and are stuck in an infinite loop of exorbitant credit card bills. Upgrade is disrupting the space by not only providing no fees and low fixed rates but also focusing on “affordable credit” and convenience by providing equal monthly payments.

In providing all these saver features that traditional banking giants cannot afford, fintech companies are able to access a new generation of customers—responsible and disciplined ones.

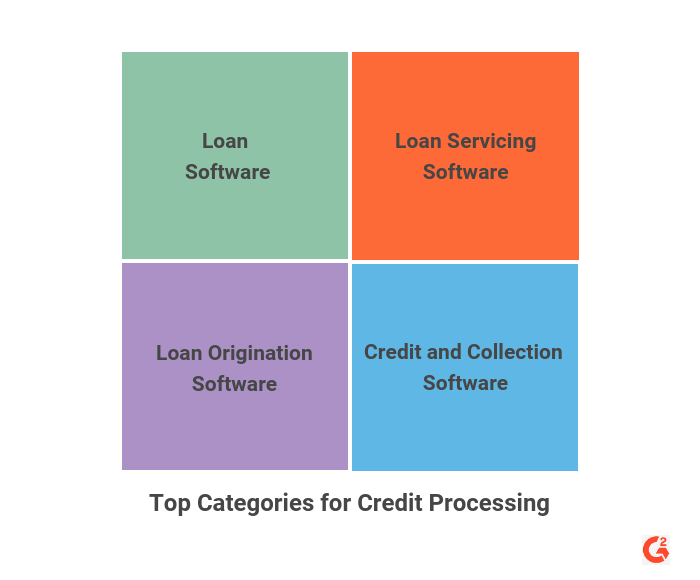

G2 categories for smooth fintech operation

G2 has several financial services software categories for smooth fintech operation. The image below provides a guide to a set of categories that help in credit processing and operations.

As the post-pandemic era witnesses a strong economic boom, businesses have begun to roar for investment and race for expansion. G2 software categories help businesses to identify the existing gaps and bridge them with the right financial capabilities.

by Subhransu Sahu

by Subhransu Sahu

by Subhransu Sahu

by Subhransu Sahu

by Subhransu Sahu

by Subhransu Sahu