Many businesses are facing difficult decisions due to the impact of global conflicts and economic uncertainty. This has also resulted in some big tech companies laying off significant portions of their workforce or slowing down product innovation. Despite this, there has continued to be an influx of investments in key technologies that enable businesses to conduct operations more efficiently, sales compensation software being a prime example.

The sales compensation market is a bright spot amid the slowdown

With increased focus on ensuring efficient and accurate compensation for sales professionals, many notable vendors have been receiving funding to help innovate the sales compensation market. Below are a few vendors, the majority of which are on G2’s Sales Compensation GridⓇ, that have recently received funding to enhance their sales compensation products:

In today’s world, virtual selling is at the forefront of business-to-business (B2B) sales, exacerbated by the pandemic, with no indications of slowing down. The rise of virtual sales has stressed the need to examine how organizations pay salespeople due to the complex and critical compensation structures that vary across businesses and deal types. Salespeople are monetarily and results driven, with quota attainment being a standard benchmark for success, underscoring the importance of appropriately and efficiently compensating performance.

What does G2 data say about the sales compensation market?

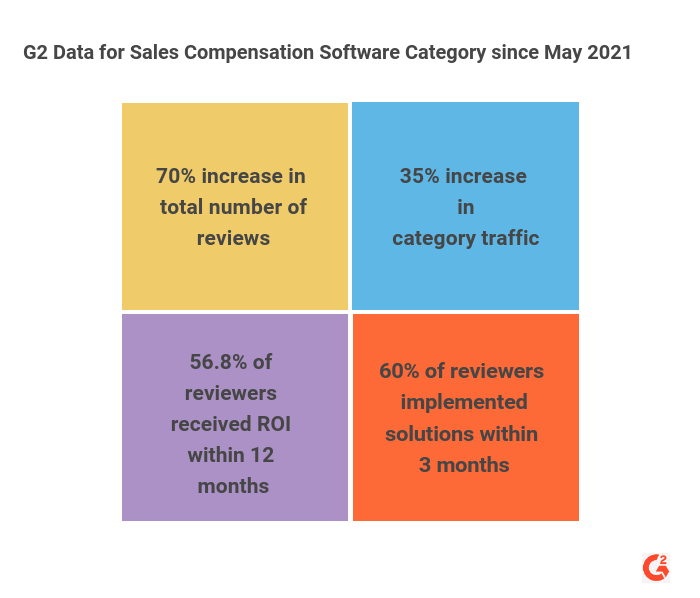

Illustrated below are trends based on G2 review data for the Sales Compensation category since May 2021:

The G2 review data highlights the increasing interest in sales compensation software to assist businesses in automating the compensation process and eliminating the need for tedious spreadsheets. The return on investment (ROI) and implementation data depicted above are favorable as companies can quickly implement solutions and recognize their value to accurately and efficiently compensate their sales professionals. As businesses focus on virtual sales, solutions like sales compensation software will likely increase in popularity to support the complex and critical compensation processes essential to B2B organizations.

Mark Schopmeyer, co-founder and co-CEO of CaptivateIQ, says:

“Sales compensation represents the single largest go-to-market investment for most B2B companies, making commissions a mission-critical process for businesses.”

With SaaS organizations continuously arising across all industries and business applications, the need for sales compensation software is unlikely to diminish. The emergence of no-code platforms to allow for flexible commission plans and ease of implementation will likely continue to be a fundamental desire for buyers seeking to sunset manual spreadsheets and seek solutions to automate sales compensation processes.

Edited by Shanti S Nair

by Blue Bowen

by Blue Bowen

by Blue Bowen

by Blue Bowen

by Blue Bowen

by Blue Bowen