FinancialForce recently announced its new services-as-a-business (SaaB) platform that aims to combine automation, intelligence, and innovation with deep industry expertise to help professional services companies adapt to challenging times.

SaaB is a vision or approach rather than a technical platform, which may be precisely what services companies need right now. So let's examine what it means, how it can benefit businesses, and its potential limitations.

Tech alone is not enough for professional services companies

If you've been involved in software selection and implementation for professional services, you probably realized that the technology and services provided by vendors tend to be disconnected. In other words, buyers invest in software, but services other than implementation and training are optional. An example would be business process reengineering, which professional services automation (PSA) software buyers often overlook because it can be time-consuming, disrupting, and expensive.

The PSA market is evolving, bringing new opportunities to buyers and challenges. On the one hand, new players bring modern alternatives to legacy software. On the other hand, these solutions are usually project management software that evolved to include additional functionality for professional services companies, such as resource management or project costing. However, these new features are still fresh and not always robust. Not to mention that these vendors don't always have deep experience with end-to-end professional services processes.

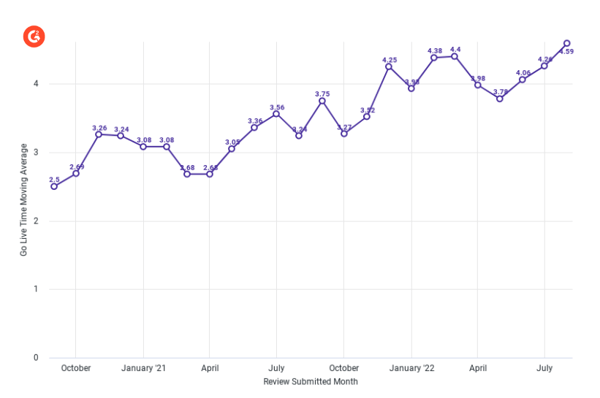

As a result, PSA buyers may choose incomplete solutions and cannot always rely on vendors to help them implement industry best practices and improve processes to make the best of their software. Surprisingly, the average go-live time for G2's Professional Services Automation (PSA) category almost doubled in the last two years, even though most products are cloud solutions that are theoretically easier to implement. The graph below shows that the average go-live time for the PSA category was 2.2 months in October 2020 and 4.59 months in July 2022.

Average go-live time for G2's Professional Services Automation (PSA) category

This is why vendors' services and industry expertise are critical to the successful implementation of PSA software. FinancialForces' SaaB has the potential to fill this gap in the industry.

Why FinancialForce SaaB matters and who benefits

This approach is more likely to benefit medium to large companies but may be cost-prohibitive to small businesses. At the same time, small professional services companies don't have complex processes and may not need SaaB.

Also, professional services companies that use multiple software solutions other than FinancialForce may find it difficult to apply industry best practices across the company and all its software solutions.

Only time will tell how well SaaB will work for PSA, but I hope to see more similar initiatives in the industry and in the wider ERP space.

by Gabriel Gheorghiu

by Gabriel Gheorghiu

by Gabriel Gheorghiu

by Gabriel Gheorghiu

by Gabriel Gheorghiu

by Gabriel Gheorghiu