The e-commerce software market is going through unprecedented changes as it reaches maturity. Vendors are now focusing on advanced technology like artificial intelligence (AI) to tackle complex issues like supply chain instability, cross-border commerce, and online fraud.

To better understand what’s happening and why it matters to buyers and sellers, I decided to summarize and analyze e-commerce news every month, starting with April.

Difficult times ahead for e-commerce sellers, buyers, and software vendors

As the economy slows down with only 1% GDP growth in Q1 2022, consumer spending was up only by 0.2% in February, hitting e-commerce platforms, mainly Amazon, which had the slowest growth in sales since 2001. Also, Shopify stock has lost 70% of its value in 2022, q-commerce provider Gopuff announced it’s laying off 3% of its workforce, and one-click checkout company Fast shut down.

Other than slowing spending and supply chain disruptions, e-commerce vendors spend huge amounts of money to remain competitive in an oversaturated market with thousands of solutions. In April, Amazon acquired social commerce company Glowroad, Shopify invested in recommendations platform Crossing Minds and plans to buy fast shipping provider Deliverr, and Microsoft invested in B2B platform Udaan. Also, Eurora raised $40 million to automate e-commerce shipping compliance, and two e-commerce intelligence companies, PipeCandy and Netrivals, were acquired.

All these investments have one thing in common. They focus on technology and services to help sellers compete in a market where anyone can create a store and start selling online. When thousands of sellers offer the same or similar products, the only way to gain a competitive advantage is to adopt advanced technology and try creative business strategies.

Sellers need to revamp strategies to gain a competitive edge

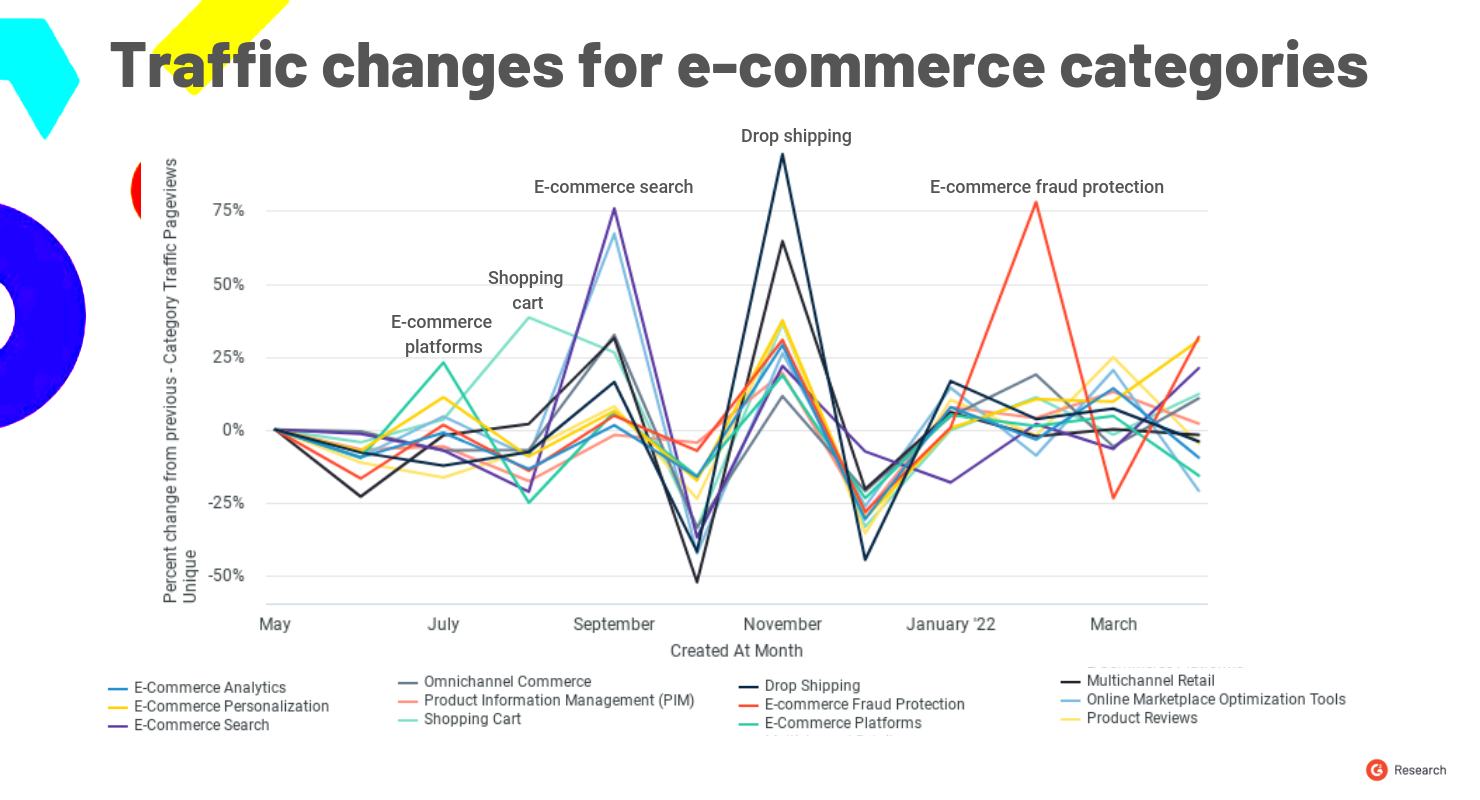

G2 data confirms the trend mentioned above, as category traffic growth for E-Commerce Platforms and Shopping Cart Software gets less significant than other categories like Multichannel Retail Software. In the past 12 months, the categories with the highest increase in traffic were E-Commerce Search Software, Drop Shipping Software, and E-commerce Fraud Protection Software.

For sellers, updating their software alone isn’t enough to stay competitive. They need to adopt new strategies based on collaboration and show that they listen to consumers, including:

Sustainable e-commerce growth won’t be driven by software but by buyers who trust brands, requiring sellers to focus on coopetition (cooperation with competitors) to put consumers first.

E-commerce trends to watch out for

I expect that other e-commerce vendors and sellers will perform less than expected. Unfortunately, some of them may also announce layoffs.

What I hope to see is more focus on fraud. While 78% of consumers experienced payment card fraud in an online store in March, I haven’t seen significant investments or acquisitions in this space in April.

Edited by Shanti S Nair

by Gabriel Gheorghiu

by Gabriel Gheorghiu

by Gabriel Gheorghiu

by Gabriel Gheorghiu

by Gabriel Gheorghiu

by Gabriel Gheorghiu