As rappers have taught us, with success comes droves of haters ready to jump at any sign of failure or weakness.

It’s happened with Slack, the undisputed king of internal communications software.

But taking a step back, it’s understandable that Slack’s competitors would be a little salty — its product is hard to hate as evidenced by its stellar 4.5 star rating on G2. Slack has reshaped how businesses connect their workforce. It has become so prominent that “slacking” has become workplace slang for messaging someone.

Competing against a business with its own slang can feel pretty unfair.

In June, Enterprise Technology Research (ETR) released a report indicating more enterprise-level businesses were moving from Slack to Microsoft Teams. The survey touts responses from around “900 CIOs and other high-level enterprise IT decision-makers… including nearly the entire Fortune 100 and nearly 40% of the F-500.” In the wake of Microsoft Teams’ apparent success in the enterprise market, folks were quick to foretell doom for Slack.

However, a closer inspection of ETR’s data raises some questions.

The survey only gathered responses from high-level IT decision-makers about their choice to purchase either Microsoft Teams or Slack. But what about user adoption? Are employees actually using the chat software purchased by their employer? IT implementation teams have a vested interest in employees using the software they purchase, meaning they could be biased in perceiving rates of adoption.

Needless to say, user adoption is important for businesses to consider if they don’t want to waste money on a product their employees won’t use.

| TIP: If your business is wasting money on tools it isn’t using, G2 Track can help reduce what you spend. |

How do Slack and Microsoft Teams compare in terms of user adoption?

The goal of our survey was to measure both perceived overall adoption and self-reported adoption of either Slack or Microsoft Teams as the main channel for communication within a workplace. Respondents were also asked to identify themselves as an IT implementation decision-maker or an end user of the software.

Our sample consisted of the following:

- 515 total respondents

- 212 Slack users: 101 IT implementation decision-makers, 111 end users from a variety of departments

- 303 Microsoft Teams users: 102 IT implementation decision-makers, 201 end users from a variety of departments

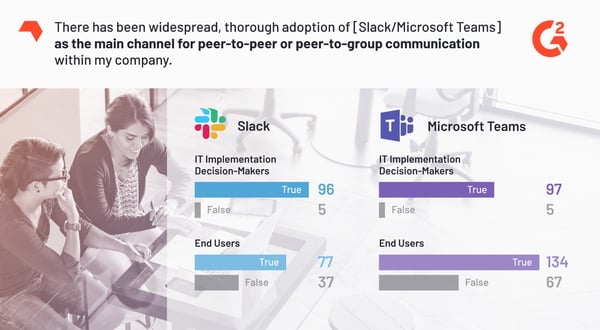

End users account for the majority of those who do not perceive widespread adoption

Overall, the majority of respondents reported widespread adoption for both Microsoft Teams and Slack. However, IT decision-makers were more likely to report perceived widespread adoption compared to end users in both cases.

With Slack, 42 respondents did not agree it had been widely adopted by their company. Of those responses, 88.1% were end users.

In the case of Microsoft Teams, 72 respondents answered “False” on the question of perceived adoption. Of those, 93.1% were end users.

While the majority of users of both Slack and Microsoft Teams perceive high adoption throughout their organization, end users are more likely to account for those who don’t compared to IT implementation decision-makers.

End users account for the majority of self-reported non-adopters

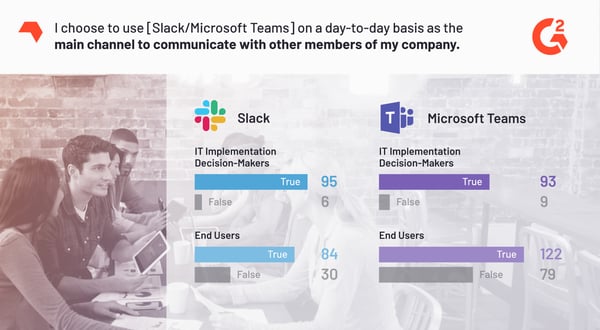

Respondents in our survey were asked to report their own adoption of Microsoft Teams or Slack as their main channel for communication within their workplace.

We found that the majority of users (across both products and types of users) reported they use the product purchased by their business. However, there’s a significant difference in self-reported adoption between IT implementation decision-makers and end users.

For Slack, 95% of IT decision-makers reported using the tool as their main method of communication, compared to 75% of end users. This means while only 5% of our sample of IT decision-makers using Slack didn’t adopt the product, a quarter of end users didn’t either.

The difference between self-reported adoption in IT implementation decision-makers and end users is more extreme for Microsoft Teams. 91% of IT decision-makers reported adopting Microsoft Teams after purchasing it. In the case of end users, only 60% reported adopting the product after their organization purchased it. This means 40% of end users of Microsoft Teams did not adopt the product as their main communication channel.

IT implementation decision-makers are both more likely to perceive widespread adoption of a product they’ve purchased, and to adopt that product themselves, when compared to their coworkers. The opinions of IT implementers cannot accurately account for the businesses they represent.

Data says small businesses use Slack; enterprise businesses use Teams

Another potential issue with the ETR data is that it only accounts for enterprise-level businesses. While enterprise businesses have a lot more cash to throw around, they are by no means the only type of business that uses business instant messaging software.

How is Slack faring against Teams in the SMB arena?

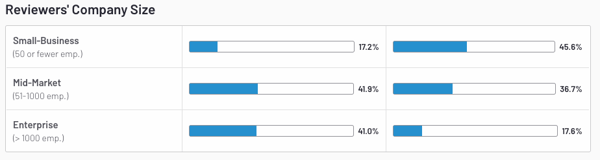

I had this data on hand from writing a blog on Slack’s IPO outlook in June. According to G2’s review data, almost half of Slack reviewers work for small businesses. On the other hand, only 17.2% of Microsoft Teams reviewers hail from small businesses, and the rest are a nearly even split between mid-market and enterprise.

Microsoft Teams’ and Slack’s reviewer company size breakdown, respectively

Microsoft Teams’ and Slack’s reviewer company size breakdown, respectively

While Microsoft Teams is more popular than Slack among mid-market and enterprise businesses, Slack’s small business dominance shouldn’t be overlooked.

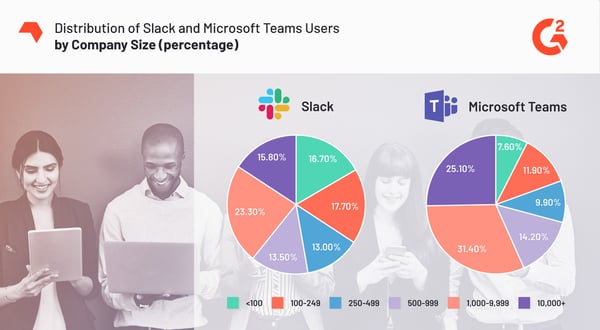

Within our sample group, there was an even distribution of respondents from companies of different sizes that use Slack. Within the Microsoft Teams segment, there was a noticeable lean toward respondents from larger businesses.

As mentioned above, ETR’s sample only uses data from enterprise-level businesses. It’s well documented that Microsoft Teams is more popular than Slack within this segment, so the fact that large companies are decreasing their spending on Slack isn’t a new revelation.

Why might this be? Enterprise-level businesses are more likely to have enterprise plans of Office 365 which have Microsoft Teams included in the package. These businesses could be looking to avoid paying for additional tool that they’re already being provided in a bundle.

Is Microsoft Teams actually crushing Slack?

Based on our findings, no. Slack will live to see many more prosperous days, to the dismay of Teams enthusiasts everywhere.

While Teams is undeniably doing well in the enterprise market, Slack has found a comfortable place in the small business ecosystem. Mid-market can be considered a more competitive battleground, with each encroaching from opposite ends.

Even while enterprises are moving toward Microsoft Teams, our data indicates end users are less likely to adopt Teams when compared to intended Slack end users. Perhaps end users will cave and eventually adopt, but until then, plenty of enterprise businesses are spending money on licenses that aren’t used to their full potential.

At the very least we can assume that IT implementation decision-makers aren’t a solely reliable source when measuring adoption. Possible reasons for their self-report patterns could be confirmation bias or sunk cost fallacy. Maybe even both.

by Jazmine Betz

by Jazmine Betz

by Jazmine Betz

by Jazmine Betz