Most industries rely on fixed assets such as equipment and tools to manufacture, distribute, and service their products.

Buyers from these companies have multiple options when looking for the right asset management software for their needs, which are often complementary and offer overlapping functionality.

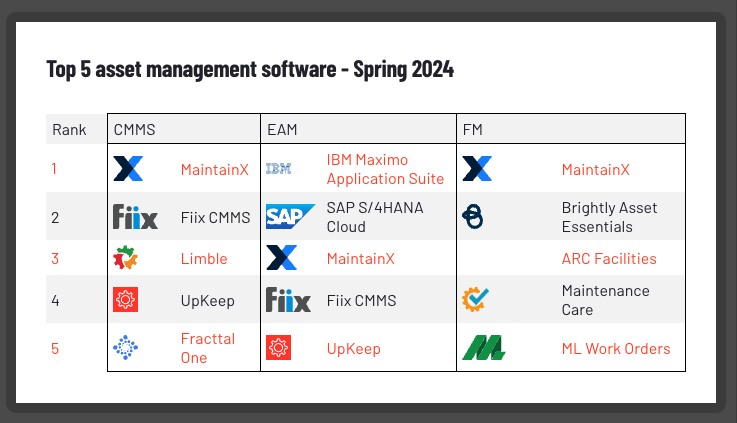

To help them make informed decisions, I analyzed G2 reports for asset management released in Spring 2024. This post will provide an overview of the market's leading players and our reviewers' feedback for each category.

Who's who in the asset management software market in 2024

The top three categories by traffic were Computerized Maintenance Management Systems (CMMS), Enterprise Asset Management (EAM), and Facility Management, which are also the leading software solutions companies use to maintain assets.

The other solutions are point solutions with limited functionality (such as calibration) or advanced software geared towards large companies with complex operations (like asset performance management).

When looking at the highest-rated products by category, I noticed that only one was in all three lists among the top five products by category: MaintainX.

A few products were in two categories: Fiix CMMS and UpKeep in CMMS and EAM.

It is worth mentioning that some vendors focus on only one category, such as SAP and IBM, which provide asset management software for the enterprise. There are also solutions specifically designed for facility management, such as ARC Facilities.

Finally, since Spring reports were released in March, the rankings by category changed.

Some of the most significant changes were:

These changes, or lack thereof for EAM, indicate that the market for asset management is competitive for SMBs but dominated by a few vendors for the enterprise.

To further help buyers, I also analyzed satisfaction criteria for the three categories.

Challenges associated with the purchasing and use of asset management software

While reviewers gave high and very high satisfaction ratings to most products across all categories, there were significant differences between the minimum and maximum scores for ease of setup.

The average rating for this criterion was around 83% for all categories, and the maximum average was 94% and higher. Still, the minimum average score was 63% for CMMS and EAM and 71% for facility management.

The average adoption was relatively similar by category, but there were significant differences in the minimum and maximum levels. For instance, facility management had a minimum adoption of 20%, much lower than EAM with 49% and CMMS with 43%.

While the average is relatively high across all categories, buyers need to remember that the products they evaluate may have a significantly lower (or higher) adoption rate. Ease of setup usually impacts adoption, especially for complex software like asset management.

Finally, it was surprising that the average buyer from all three categories only achieves positive ROI after their contract ends. As shown below, the average time needed to achieve ROI is significantly higher than the average contract length combined with the average time to go live.

This is a concern for both buyers and vendors.

On one hand, buyers need to sign a new contract for at least 12 months to achieve ROI, which increases the overall cost of the software, thus impacting ROI. On the other hand, vendors may have difficulty convincing buyers to renew their contracts without achieving ROI.

A potential solution to this conundrum would be for buyers to sign at least a two-year contract, which may also get them a discount, thus making ROI easier to achieve.

What's next for asset management software

I expect to see further changes in rankings in future reports, but only a limited number of vendors will switch places in the top five. EAM will remain an exception, with SAP and IBM most likely in the top 5.

The only thing that may tip the balance is the advent of artificial intelligence (AI) and generative AI (GAI) technologies, gradually adding to asset management.

Smaller vendors can use GAI to improve their products and gain a competitive advantage. At the same time, large vendors will add GAI to their offerings but are more likely to consolidate their market position through industrial AI.

CMMS has been around since the 1960s; learn how cloud computing contributed to its growth.

Edited by Sinchana Mistry

by Gabriel Gheorghiu

by Gabriel Gheorghiu

by Gabriel Gheorghiu

by Gabriel Gheorghiu

by Gabriel Gheorghiu

by Gabriel Gheorghiu