As companies across the globe look to enhance their digital capabilities, regional variations in software purchasing trends become increasingly visible.

Earlier this year, G2 published the 2023 G2 Software Buyer Behavior Report, which analyzed software buyer behavior across the globe.

The Asia-Pacific (APAC) region, comprising diverse markets such as India, Singapore, Australia, and more, is witnessing distinct software purchasing trends characterized by a high optimism in spending and investment and a focus on AI functionality.

Optimism in spending and investment

Companies in the APAC region, particularly India, are expressing optimism about increased software spending in 2023 and 2024 compared to other regions. APAC companies anticipate increased investments in various areas, with a particular focus on analytics and AI.

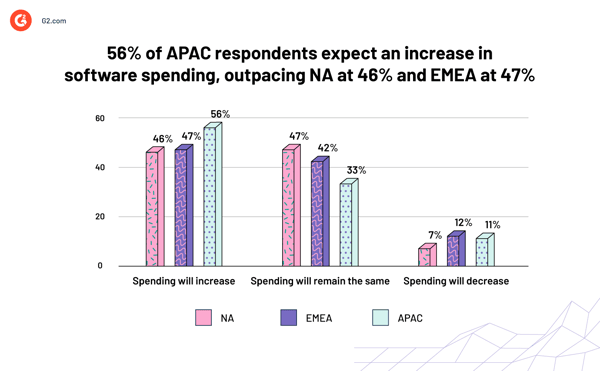

In 2023, 56% of APAC respondents expect an increase in software spending, outpacing North America (NA) at 46% and Europe, the Middle East, and Africa (EMEA) at 47%. India is even more optimistic, with 63% anticipating an increase.

In terms of specific areas of investment, APAC companies lead in their enthusiasm for analytics, with 75% expressing interest, while NA stands at 55% and EMEA at 70%. This indicates APAC's recognition of the importance of data-driven decision making.

For the following year, 2024, the optimism continues in APAC, with 65% expecting increased spending. India stands out with a whopping 79% expressing confidence in increased software spending in 2024.

APAC’s affinity for AI

The APAC region, with India at the forefront, shows a heightened interest in AI functionality in software purchases. APAC respondents generally exhibit higher trust in the accuracy and reliability of AI-powered solutions compared to other regions.

APAC companies place a higher importance on AI functionality in the software they purchase, with 47% considering it "very important." This emphasis surpasses the figures for NA (40%) and EMEA (31%). India, once again, leads the way with 56%.

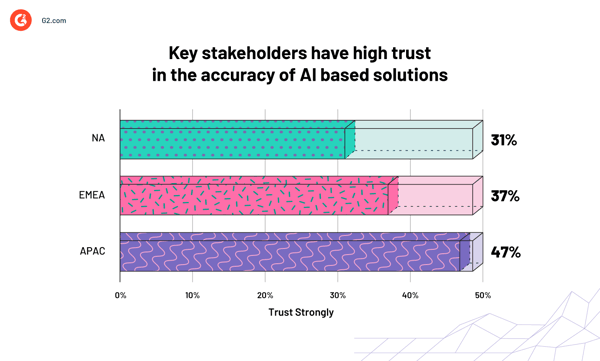

In APAC, 47% strongly trust the accuracy and reliability of AI-powered software solutions, surpassing NA (31%) and EMEA (37%). India is again especially confident, with 65% expressing trust, while the rest of APAC follows at 30%.

This dynamic and evolving landscape of technology adoption in the region is driven by security concerns and a desire to leverage cutting-edge technologies for business growth.

Speed to market challenges APAC's strong emphasis on security

Security and privacy are paramount when it comes to software purchasing in the APAC region.

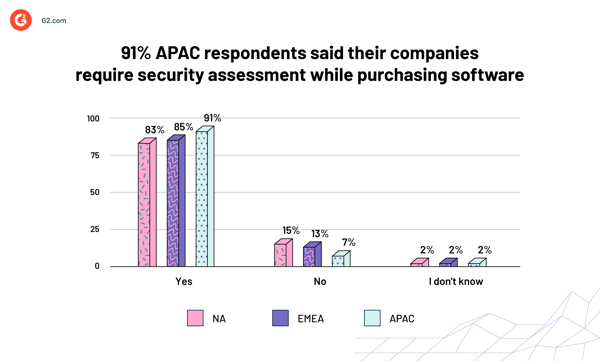

A significantly higher percentage of companies in APAC, including India, require security or privacy assessments when purchasing software compared to their counterparts in NA and EMEA.

A staggering 91% of APAC respondents said they conduct security assessments during software purchases, whereas in NA, the figure stands at 82%, and EMEA follows at 85%. Notably, India takes the lead in APAC, with 97% of respondents saying they require security assessments.

In APAC, 91% of respondents considered a vendor's history with breaches or security incidents when evaluating software solutions, reflecting a higher awareness of vendor reliability. In contrast, NA and EMEA reported relatively lower percentages at 84% and 81%, respectively. India surpassed the APAC average with 96%, while the rest of APAC stood at 87%.

However, despite this strong emphasis on security, APAC is also more prone to purchasing shadow IT—software not approved or vetted by IT or InfoSec teams.

Approximately 64% of respondents in APAC admitted to this practice, compared to 43% in NA and 62% in EMEA. The differences within APAC are also quite stark, with 81% of respondents from India admitting to purchasing shadow IT compared to 51% in the rest of APAC.

The primary driver for purchasing unvetted products in APAC is the need to move quickly, with 86% of respondents citing speed as a crucial factor. This indicates a need to balance the urgency to adopt new technologies and the importance of security and privacy considerations.

APAC buyers not only prioritize security and privacy but also look for seamless integration with existing solutions and consistency in their technology stack, shaping their vendor selection and contract renewal strategies distinctly from their counterparts in NA and EMEA.

Consistency and quality are key considerations in vendor selection and renewal

When it comes to selecting software providers and renewing contracts, APAC respondents showcase distinct preferences.

For software contract renewals, APAC focuses on the frequency of software usage, while NA and EMEA prioritize user satisfaction. Quality is also a key factor influencing renewal decisions in the APAC region.

Amongst those who prefer multi-year contracts, APAC buyers are driven by the desire to maintain a consistent technology stack (27%) when considering multi-year contracts.

While the respondents from the rest of APAC are more influenced by discounts (31%), respondents in India emphasize the need for consistency (23%).

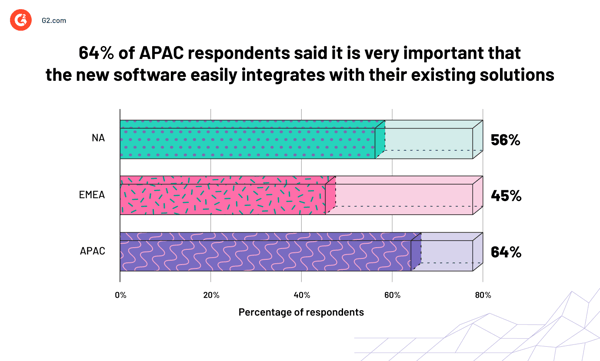

When asked how important is the integration of the new software with the existing solutions, 64% in APAC said it was the most important, compared to 56% in NA and 45% in EMEA.

This means that APAC places a strong emphasis on the integration of new software with existing technology management and monitoring solutions.

These trends highlight the region's strong commitment to security and privacy, as well as its optimism in technology spending and investment.

This unique blend of priorities positions APAC as a dynamic and innovative force that is both security-conscious and forward-thinking in its approach to technology adoption.

G2's recommendations

Given the distinctive preferences and priorities observed in the APAC region regarding software purchasing and vendor selection, it is imperative for businesses operating in this region to tailor their approaches accordingly.

Some recommendations that G2 believes can help vendors are:

Provide enhanced security measures

With the importance of security and privacy in the APAC region, software vendors need to strengthen security protocols, invest in robust cybersecurity tools, and conduct regular assessments to meet the high expectations of APAC clients.

Assure reliability

Vendors need to build trust and credibility among clients, enhancing the chances of successful partnerships. They can achieve this through references, testimonials, reviews of existing customers, and through industry influencers.

Highlight seamless integration

Emphasize the compatibility of your software with the client’s current technology management and monitoring tools. This can significantly influence purchasing decisions, particularly in APAC, where integration holds the highest priority.

Vendors that follow these recommendations can foster successful relationships with buyers, and thrive in the APAC market, positioning themselves as trusted allies in the region's ever-evolving technological landscape.

Read the full 2023 G2 Software Buyer Behavior Report to discover trends from across the globe.

Edited by Jigmee Bhutia

by Tian Lin

by Tian Lin

by Tian Lin

by Tian Lin

by Rachana Hasyagar

by Rachana Hasyagar