A lot of moves are being made in the blockchain world, with mergers and acquisitions apparently driven by an expanding interest in both institutional and individual investors. These same drivers pushed Bitcoin to over $50,000 and traffic to G2’s Cryptocurrency Mining Software category sevenfold. This growth isn’t sustainable, but it hasn’t wavered.

The interest in cryptocurrency is currently outpacing blockchain-based business technology. That is by design since many of the B2B solutions rely on a healthy flow of transactions to ensure each blockchain’s efficacy.

Institutional investments have helped develop applications with practical business purposes. However, many of these off-chain applications necessitate high volume trading to operate efficiently, in effect, driving up cryptocurrency value and interest from everyday cryptocurrency traders.

Applications on a main blockchain such as the Ethereum 1.0 network would only facilitate around 30 transactions per second. However, off-chain or layer 2 blockchain applications, built on a private layer abstracted from the original blockchain, can do anything from scale up transactions 100x to integrate off-chain data from smart contracts.

Factors influencing growth of cryptocurrency market

It’s difficult to determine all the factors pushing individual investors to consider cryptocurrency. For the average person, the economy has not felt stable for over a year now, but one thing has seemed to guarantee short-term profits—cryptocurrency.

While the everyday crypto-aficionado is looking to mine and take advantage of cryptocurrency tools, businesses and banks appear to be focusing their investments on blockchain software and its component technologies rather than the cryptocurrency itself. Even the least experienced crypto miner can download a tool like Salad which uses a computer's reserve resources to mine currency.

One Salad reviewer said:

"Salad itself provides a great source of secondary income to those with personal computers. Just this month alone I personally have made 100 dollars, entirely within my sleep! All that needs to be done is turn Salad on and leave your computer running."

In March 2020, when everyone was forced to deal with the impacts of the pandemic, one Bitcoin had the value of $8903, according to YCharts. By March 1, 2021, that number would quadruple, having peaked in February 2021 at more than $50,000. Bitcoin is not alone in its gains. Over the past year, Ethereum, the second-most popular cryptocurrency in circulation has risen from around $200 to nearly $2,000 in February, hovering around $1800 through early March this year.

Most coins have hung onto Bitcoin’s coattails. Virtually all coins including Litecoin, Ripple, Stellar, and more, at least doubled in value this year. Even Dogecoin, a fading meme currency that started as a joke, rose from less than a single penny one year ago to more than 5¢ in March 2021.

For us—that translated to a massive increase in traffic from visitors to our various Cryptocurrency categories. The biggest of which was seen in the Cryptocurrency Mining category. I believe that is mostly the result of increased interest from retail investors and those looking to dip their toes in the mining pool.

Categories across the blockchain ecosystem have benefitted, indicating interest from both individuals and businesses. Institutional investors might not be as interested in mining individual coins, but they are much more interested in developing decentralized finance tools for B2B uses.

Many of these decentralized finance tools rely on frequently used blockchain ledgers powered by individual transactions. Those platforms supporting smart contracts, layer 2 protocols or other applications built on the blockchain need these transactions for reference when authenticating new ones, especially when increasing scale and speed.

Institutional investment drives crypto interest

Earlier this year, Bank of New York Mellon participated in the $133 million investment of Fireblocks, an asset tokenization platform. A company called NYDIG, which provides “alternative asset manager,” and other cryptocurrency-related services, received a $200 million investment from Morgan Stanley, New York Life, and others.

Aside from banks, FinTech giants have been very active in their funding and development of cryptocurrency-related technologies. PayPal just acquired Curv, an Israeli cryptocurrency startup that develops tools for digital asset security using patented multi-party computation (MPC) protocols.

Institutions across the world are getting involved as well. Latin America’s biggest asset management firm, Giant Steps Capital, invested in a cryptocurrency startup called Polvo Technologies earlier this month. The total investment was undisclosed, but the intention and interest across continents both led to an institutional belief in the technology’s potential and efficacy.

This has been a trend for more than a decade, starting with early Bitcoin interest. Established companies and financial giants began experimenting with blockchain technology years ago. Today, many of the most common blockchain-based products come from major tech companies that were established before anyone mentioned the word blockchain. For example, three of the top four products in our blockchain-as-a-service company are sold by Amazon, IBM, and Microsoft.

Business applications connect institutions, businesses, and retail investors

For these institutional investors and technology companies, there’s a more visible narrative we can draw connecting the concepts of cryptocurrency and blockchain technologies to their real-world applications.

There has been broad and substantial investment into blockchain-related technology companies for years. A few years ago I would have viewed much of the blockchain investment trend as a bubble and found little practical value in many of the tools, but I think the market is proving me wrong.

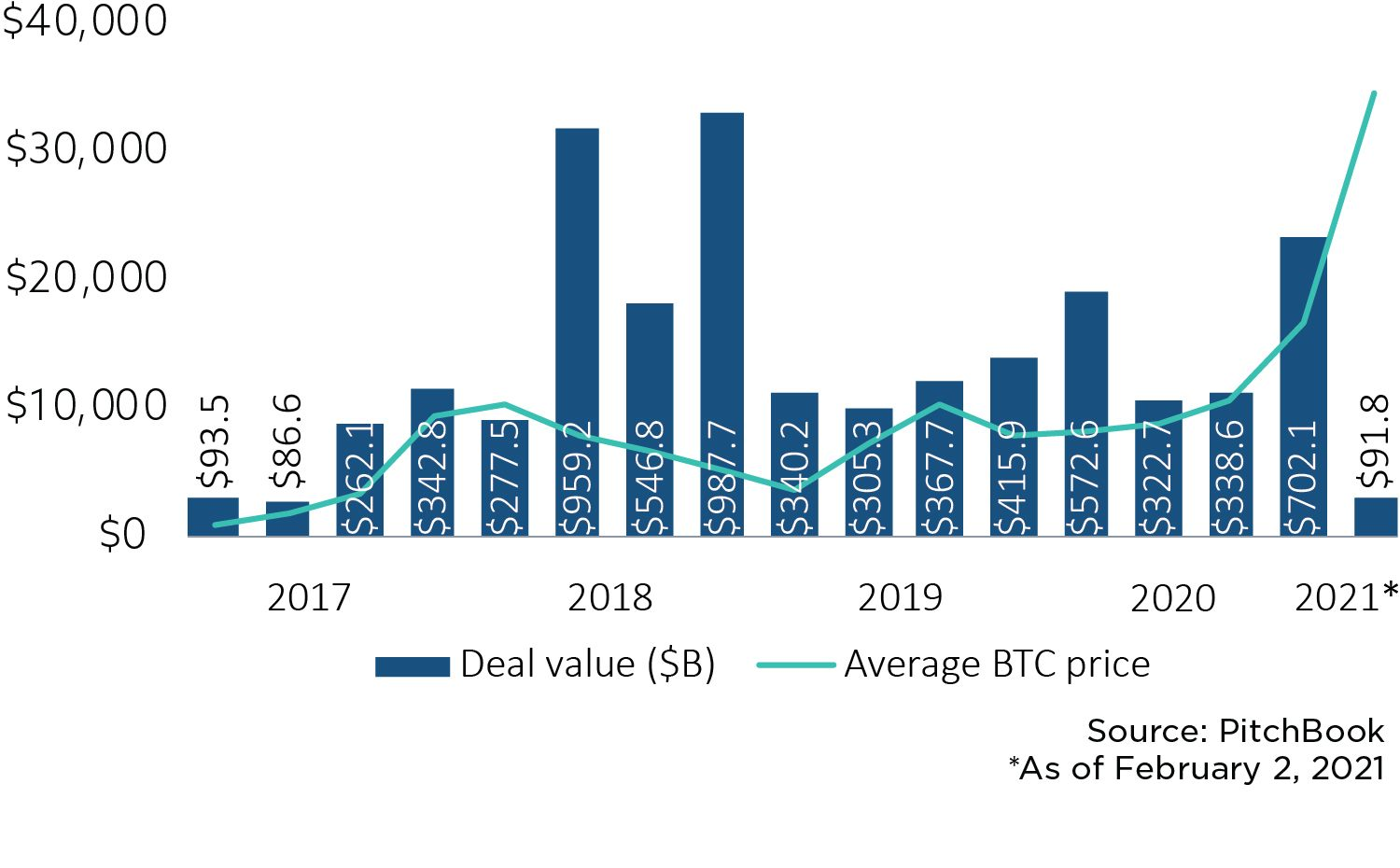

The classic examples of supply chain management and voting are fairly large industries involving many heavily established vendors—most of whom do not provide blockchain-based solutions. The rise in the value of cryptocurrency has paralleled the growth of investment in companies developing practical blockchain-based solutions.

Blockchain startup investment (Source: PitchBook)

Blockchain startup investment (Source: PitchBook)

Investment, in general, has waxed and waned, but it never fully lost momentum. And in 2021’s era of global uncertainty, it’s not likely that investors will believe the risk of blockchain investment outweighs the reward.

Thankfully, I am not alone in this belief. In a series of interviews with investors and startup leaders, Crunchbase explained a particular emphasis from venture capitalists relating to tokenization, fund administration, and central bank digital currencies. Numerous examples of this idea can be found in some of this year’s investments. The Hong Kong exchange Crypto.com has started an enormous $200 million fund specifically to fund crypto startups. This could be in response to Coinbase and their investment arm, Coinbase Ventures.

Coinbase Ventures was started nearly five years ago but has been incredibly active in 2021 already. This year alone, the fund has participated in more than 10 series A, venture, and seed round funds for crypto startups. That doesn’t even include their acquisitions of Bison Trails and Routefire.

While investors and established companies channel money into startups, some of the biggest movement is happening in a secondary layer of “off-chain” blockchain technology.

Layer 2 gives blockchain reason to exist with practical applications

The increasing value of cryptocurrencies has led to an increase in the value of specialized tokens designed for business use on those platforms. Layer 2, or “off-chain,” tokens allow for additional developments, frameworks, and protocols built on top of existing blockchains.

The original blockchain systems like Ethereum and Ripple are not able to process thousands of transactions per second, but the secondary blockchain can if operating independently on top of the original system.

These layer 2 transactions are referred to as off-chain solutions because they are abstracted from the primary chain on major platforms such as Ethereum. The abstraction allows them to operate independently, while activities remain validated by the primary ledger, allowing off-chain tools to provide numerous functionalities and a massive increase in scalability.

A good example of a layer 2 solution would be Lightning Network. Bitcoin processes 4.6 transactions per second, but Lightning, a layer-2 bitcoin protocol, built atop the original blockchain, can facilitate nearly 50,000 transactions per second. This is achieved by bypassing the on-chain ledger while still enforcing security through smart contracts on an independent ledger.

Layer 2 saw some of its biggest growth in 2020. The inherent connection to secondary, off-chain systems along with the expanded functionality they offer, has resulted in a boom in their practical and dollar value.

Chainlink, for example, is an off-chain solution that is built on Ethereum but serves to connect on-chain smart contracts with off-chain data. Since March 2020, the value of a Chainlink token has increased 1413.5% from under $2 to over $30—driven by the rise in Ethereum value with the increased usage of smart contracts.

In theory, Chainlink could be used to connect data from IoT devices, payment gateways, or cloud services onto any blockchain, not just Ethereum. This could mean anything from connecting pricing data to investors in real time to automating data integration between weather technology to assess the risk of natural disasters.

Technologies exist already to integrate data points like these, but few will ensure end-to-end encryption and blockchain validation. Another example is Stellar, a blockchain platform similar to Ethereum. It’s designed to facilitate global, scalable payments verified by its own blockchain platform. Stellar Lumens are a protocol or altcoin, users can buy and sell to keep the core blockchain platform moving. The Stellar network requires continuous, legitimate transactions to ensure the validity and efficiency of each transaction.

Lumens may not look that appealing with a value of about $.45, but that number increased from $.03 just a year ago. The low cost, along with over 100 billion in circulation has made the coin appealing for high-volume transactions from both businesses and individuals.

Many of the layer-2 coins on the market today could exponentially increase in value as a large number of businesses and cryptocurrency enthusiasts believe they possess practical usability. Users interested in these coins can explore mining them directly or take their own path through a cryptocurrency exchange.

Either way, altcoins will continue to increase in value as well as popularity. So for businesses, there are tons of new protocols to help simplify everyday business problems—and for individuals with spare cash or compute capacity, many believe it’s a good time to get in. This interest has caused traffic to G2's Cryptocurrency Mining category to multiply seven times over.

Many individuals driving G2's traffic growth are interested in financial gain during the uncommonly unpredictable atmosphere we find ourselves in today. If you’re one of those people, you may take a look at G2's Cryptocurrency Mining category to get a taste of your options. Here’s a sneak peek of the top cryptocurrency mining software according to G2 data:

| Top Cryptocurrency Mining Software |

Number of Reviews |

Star Rating |

| Salad |

34 Reviews |

4.5 out of 5 Stars |

| MinerGate |

22 Reviews |

4.1 out of 5 Stars |

| NiceHash |

18 Reviews |

3.9 out of 5 Stars |

| CGMiner |

20 Reviews |

3.9 out of 5 Stars |

| MobileMiner |

11 Reviews |

3.1 out of 5 Stars |

If you’re a business or you’re just looking to educate yourself on some of the cutting-edge tools gaining popularity in the blockchain and cryptocurrency worlds, there are a number of categories that might interest you under G2's Blockchain Software umbrella.

by Aaron Walker

by Aaron Walker

by Aaron Walker

by Aaron Walker

by Aaron Walker

by Aaron Walker