G2’s Market Research is passionate about helping buyers find software solutions across all categories that can best solve their business problems.

Our goal is to create the best possible reflection of what buyers experience when they select software and services that underpin strategies to delight customers and grow their businesses.

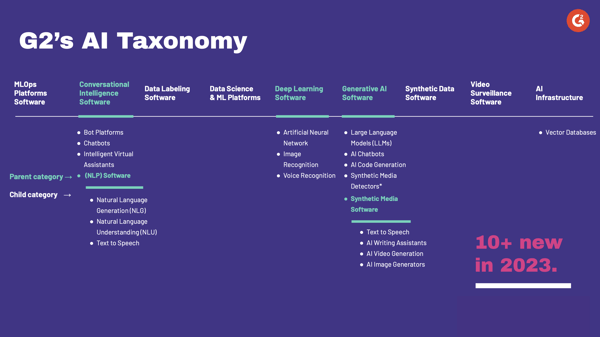

To help buyers find relevant offerings, G2 categorizes products and services into at least one category based on the functionality of the software or service. G2 maintains a taxonomy, with categories used to classify different types of business software and services.

Think of it like a giant org chart of the entire B2B software landscape. This category hierarchy showcases all 2,200+ categories in our marketplace.

The AI landscape changes at a pace not seen in any other part of the software industry

Artificial Intelligence (AI) software has boomed over the past year – especially since the launch of ChatGPT at the end of 2022.

On G2, today, there are 21 AI categories featuring 1,078 AI vendors and 1,232 AI products – receiving 37,823 reviews - and these figures are growing every minute.

Everything from CRMs to finance technology has been injected with generative AI capabilities.

In fact, according to our inaugural State of Software Report (Q4 2023), we observed that AI was the fastest-growing software market over the past year, growing 39% between September 2022 and September 2023 – with AI categories gaining 643 new products!

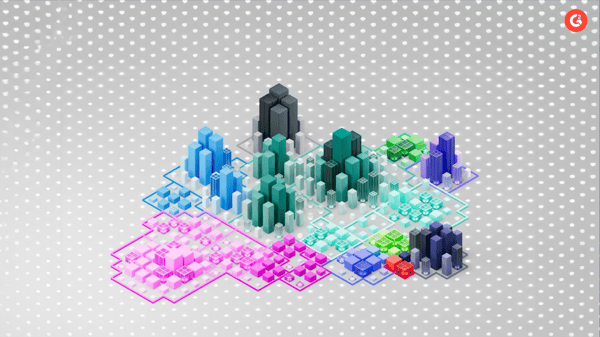

Unveiling G2’s AI City: a visualized taxonomy of this fast-growing, evolving landscape

Partnering with G2’s talented design team, we asked ourselves the question...”How might we create a more engaging way to visualize and experience our taxonomy and see trends and relationships?”

So, the team created a new visual using the metaphor of a city. And so, G2’s AI city was born.

Cities have neighborhoods with different levels of development and notable characteristics. The team used color to separate the subcategories of AI into neighborhoods of a city.

Visualizing the taxonomy this way meant we could add another dimension: the size of the buildings denotes how many products are in those categories. The larger the buildings, the more products are in those categories.

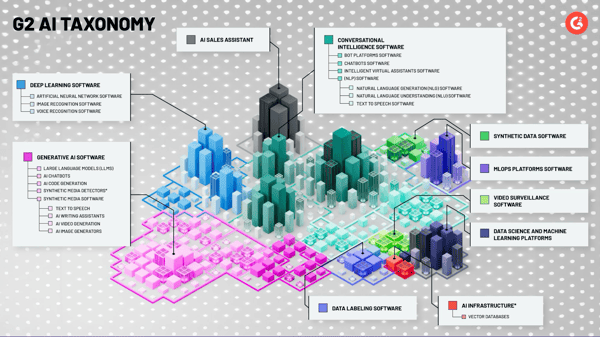

Bringing back the labels so you can see a map of the city.

What used to be branches in the taxonomy are now neighborhoods. For instance, AI Sales Assistants contains over 250 products, and you can see Conversational intelligence at the heart of the city. These are mature categories in AI. And Generative AI, because of its newness, is still relatively small.

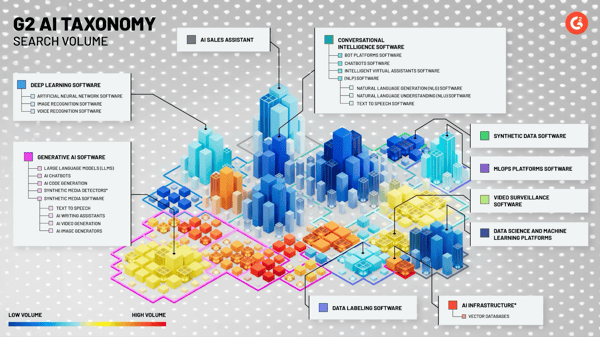

Finding where the heat is in AI

I grew up and live in the Boston area. And though it’s an old city (by U.S. standards, at least), there are still areas of rapid growth. If you’ve been to Boston lately, you might have visited the Seaport, perhaps for a conference.

Over the past 20 years, the Seaport has been where the heat is, with first a hotel and then a convention center. Today, it’s filled with new buildings and unquestionably has been the focus of development. Once an industrial shipping area filled with cargo containers, it’s exploded into a thriving center of economic growth.

Using search volume, we traced the hottest areas in AI and created an AI heat map, revealing where buyers are congregating. We created an AI heat map overlaying search volume, replacing the color palette with a scale to show where the next Seaport is in AI.

Blue is relatively cool, and red is hot.

While still an emerging space, Generative AI is absolutely the hottest part of the city right now, led by AI Chatbots like ChatGPT for content generation. Stay tuned for more on this and future iterations of our visualized taxonomy.

With this, we wanted to provide a fun way to explore AI. My colleague Matthew Miller, G2’s Research Principal covering AI and Analytics, joined me to explain our AI City concept and dive into the AI categories. Watch this video if you want to learn more.

Help make markets - join our research

The analysts on our team, like Matthew, track both new and changes to existing offerings in the areas that they cover. For instance, if they see a set of new solutions that don’t fit in some of the existing categories a buyer might be investigating, they’ll dig into whether this is truly a new category of software with a set of core features that’s different from existing categories.

They conduct this research using a variety of sources, including internet search data and insights from the G2 Marketplace. An important voice is from the vendors themselves, who eat, sleep, and breathe the needs of their customers and what competitors are doing every single day...this insight and engagement is invaluable.

Do you believe there’s a new category in AI? Reach out to us and share your perspective here, or contact us directly. We want to hear from you.

This article is co-written by Matthew Miller, Principal Analyst, AI, Automation & Analytics

This article is co-written by Matthew Miller, Principal Analyst, AI, Automation & Analytics

Edited by Sinchana Mistry

.png?width=500&name=ai%20taxonomy%20blog%20featured%20image%20(1).png)

.png?width=500&name=ai%20taxonomy%20blog%20featured%20image%20(1).png)

by Chris Voce

by Chris Voce

by Brandon Summers-Miller

by Brandon Summers-Miller

by Adam Crivello

by Adam Crivello