This post is part of G2's 2024 technology trends series. Read more about G2’s perspective on digital transformation trends in an introduction from Chris Voce, VP, market research, and additional coverage on trends identified by G2’s analysts.

One-stop shop AI sales software to drive sales execution

Prediction

In 2024, sales tech will see further convergence of features to expand and centralize capabilities. This will provide a consolidated solution for sales execution and revenue intelligence.

Buyers are seeking a unified sales solution that addresses multiple needs, and vendors will continue to emerge by expanding their offerings to accommodate this desire.

In the next year, we will continue to see revenue operations & intelligence (RO&I) solutions expand their offerings to increase adoption and reduce ROI, potentially in areas such as conversation intelligence and sales engagement, given the influx of generative AI utilization.

Conversely, there will likely continue to be new entrants in the RO&I category as solutions expand their capabilities to provide robust AI-driven predictive and prescriptive insights to drive revenue and reduce churn.

AI for sales will be the center for this convergence, as vendors leverage generative AI to create messaging and expedite outreach, predictive AI to identify trends in customer patterns, and prescriptive AI to guide on the next best steps.

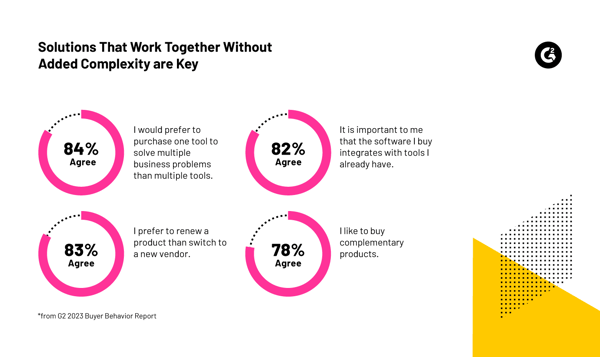

Unified solutions align with buyer preferences

G2’s 2023 Software Buyer Behavior Report revealed that buyers prefer to work with fewer vendors (78%) and use a single solution instead of multiple tools (84%), demonstrating the desire for a consolidated sales tech stack.

Additionally, 83% of respondents prefer buying products from the same vendor instead of switching vendors, indicating that as vendors expand their offerings, they may be able to reduce churn by ensuring adoption.

Source: 2023 Software Buyer Behavior Report

As buyer preferences evolve and their desire to reduce their sales tech stack increases, vendors will push product evolutions to appease these desires.

It’s unlikely that organizations will solely adopt one sales solution. But point solutions will likely be reduced if unified solutions cater to their needs and provide a centralized approach to boost sales productivity and effectiveness.

Recent activity in the salestech landscape

This trend of consolidation has just started to emerge.

Most recently, in August 2023, Groove was acquired by Clari, a leading RO&I solution to expand into sales engagement. In June 2023, Gong released new features to penetrate the sales engagement space.

Additionally, Mediafly raised $80 million in August 2023 to continue its desire to provide a holistic revenue enablement and intelligence solution, showcasing the heightened attention RO&I solutions are receiving.

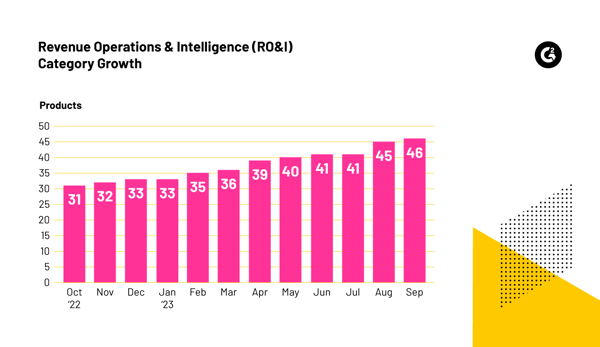

It’s clear that RO&I solutions are seeking to lead the charge in consolidating the sales tech stack, and there will likely be vendors seeking to penetrate the space.

This may be accomplished by vendors seeking to acquire companies to create a holistic platform offering or investing in developing new features and functionality internally.

As shown above, the RO&I category is growing and likely will continue to, as vendors seek to incorporate AI-driven insights into forecasting and sales engagement tactics to increase revenue and reduce churn.

Increasing adoption is critical

Historically, vendors have aimed to provide superior point solutions to gather market share.

But vendors now begin to provide a consolidated sales solution, ensuring customer adoption across all their offerings will be imperative to become a one-stop shop for sales execution.

Offering new features is great, but the key is ensuring customers leverage all aspects of the solution and value the new offerings enough to justify removing various point solutions from their tech stack.

With the influx of one-stop-shop solutions, vendors who can provide superior offerings across multiple use cases will come out on top.

Businesses are shifting focus from RevOps to RO&I to have access to enhanced revenue intelligence insights. Learn more.

Edited by Jigmee Bhutia

by Blue Bowen

by Blue Bowen

by Blue Bowen

by Blue Bowen

by Blue Bowen

by Blue Bowen